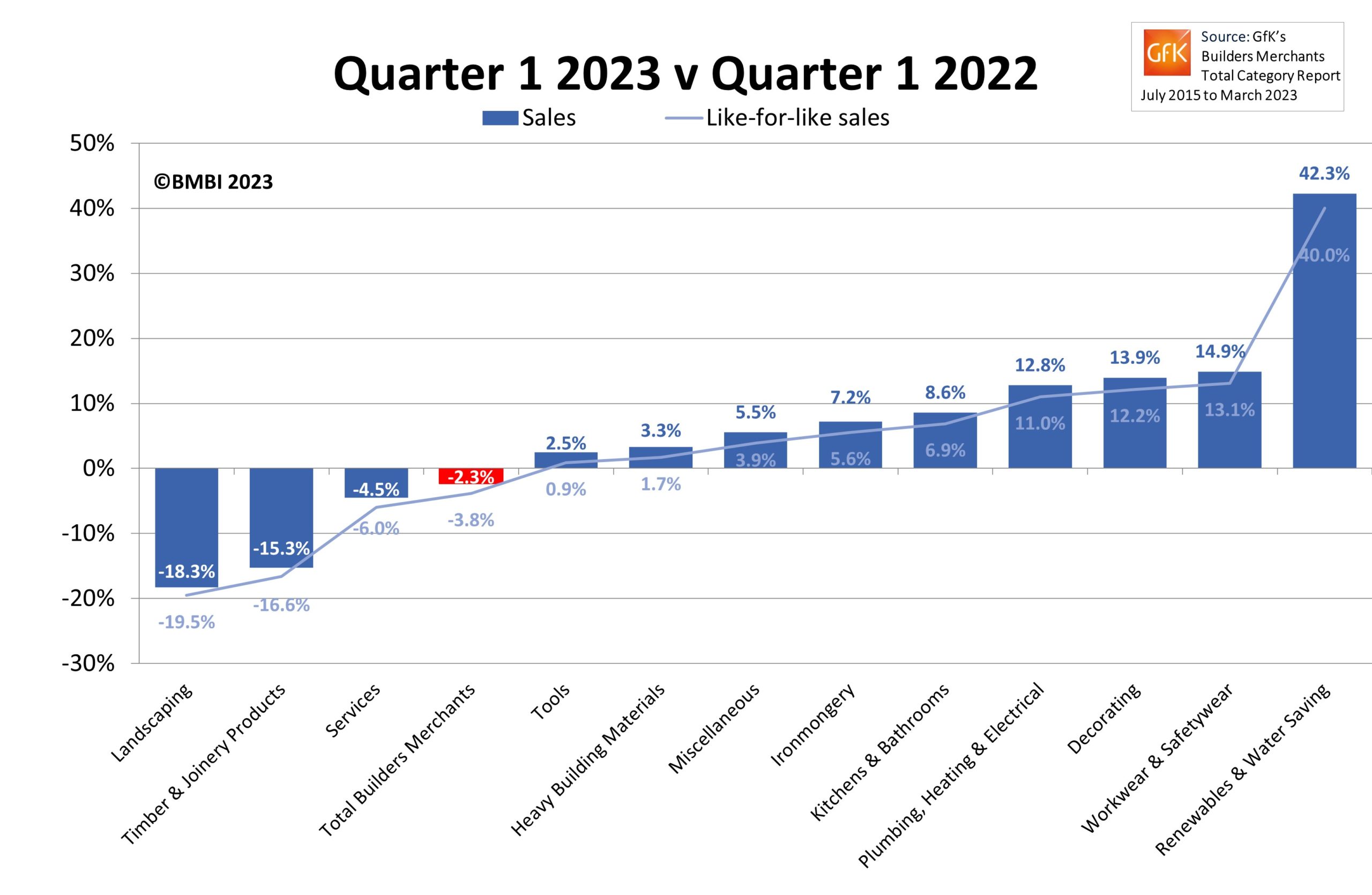

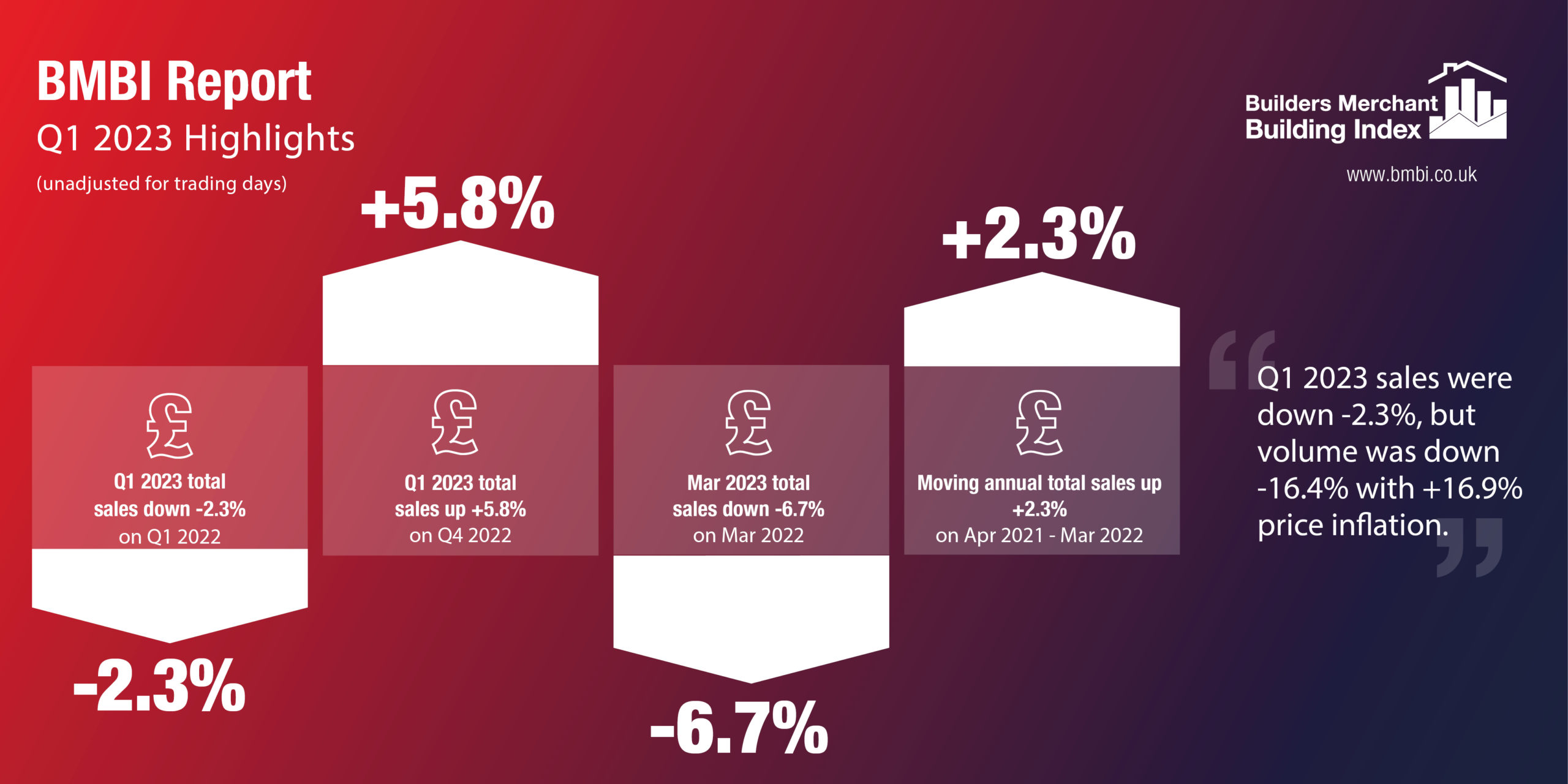

The latest figures from the Builders Merchant Building Index (BMBI), published in May, show Q1 2023 total value sales to builders and contractors recorded a -2.3% slide in year-on-year growth, with volume sales falling -16.4% countered by +16.9% price inflation. With one more trading day this year, like-for-like value sales were -3.8% lower.

Nine of the 12 categories sold more in Q1 2023 compared to the previous year with Renewables & Water Saving (+42.3%) head and shoulders above the rest. Workwear & Safetywear (+14.9%), Decorating (+13.9%) and Plumbing, Heating & Electrical (+12.8%) performed well while Heavy Building Materials (+3.3%) grew more slowly. Services (-4.5%), Timber & Joinery Products (-15.3%) and Landscaping (-18.3%) all sold less.

Total value sales were up +5.8% in Q1 2023 compared to Q4 2022. Volume sales edged up +0.6% and prices climbed +5.2%. With five more trading days in the most recent period, like-for-like sales were -2.5% lower than October to December 2022. Renewables & Water Saving (+22.3%) was the strongest category, followed by Tools (+11.8%), Ironmongery (+11.1%) and Heavy Building Materials (+6.4%). Services (-2.4%) was the weakest category.

Total value sales for March 2023 were -6.7% lower than March 2022. Volume sales fell -19.7% year-on-year and prices rose +16.2%. There was no difference in trading days. Seven of the 12 categories sold more with Renewables & Water Saving (+26.6%) again taking the lead.

March total merchant sales were +14.8% ahead of February 2023. Volume sales were +13.2% higher and price inflation was up +1.4%. All categories sold more, with seasonal category Landscaping (+25.4%) increasing the most, followed by Workwear & Safetywear (+19.3%).

Kevin Tolson, commercial director Wienerberger UK and BMBI’s expert for bricks & roof tiles said: “The first few months of 2023 haven’t been easy for the construction sector but we had been expecting it to be tougher.

“Twenty twenty-two saw an unprecedented amount of demand for construction materials, so compared to that, the beginning of 2023 was bound to seem a bit slower. On the bright side, construction work has been more active than we thought it would be, and people’s overall confidence in the economy hasn’t gone down as much as expected.

“The Office for National Statistics indicated we’re not headed for a recession this year after all, with growth predicted to be at +0.2%, which is much better than the prediction from the Winter Forecast in January that was a contraction of -0.7%.

“It’s also been great to see a real shift towards focusing on Net-Zero from many in our industry as we start this year. As manufacturers, we’ll keep finding the best solutions that meet our sustainability goals, but we’ll also make sure we’re still offering the best products and solutions for our trade customers.”

Want to know more?

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

| The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |