The latest figures from the Builders Merchant Building Index (BMBI), published in July, reveal that builders’ merchants’ value sales were up +12.4% in May compared to April 2023. Volume sales were up +14.1% while prices decreased slightly (-1.5%). With two extra trading days in May, like-for-like value sales were up +1.1%.

All categories sold more with Landscaping (+18.6%) and Heavy Building Materials (+13.3%) growing the most. Workwear & Safetywear (+11.3%), Decorating (+10.7%), Timber & Joinery Products (+10.6%) and Ironmongery (+10.3%) also hit double digit growth, while Plumbing, Heating & Electrical (+7.1%) and Tools (+7.2%) grew the least.

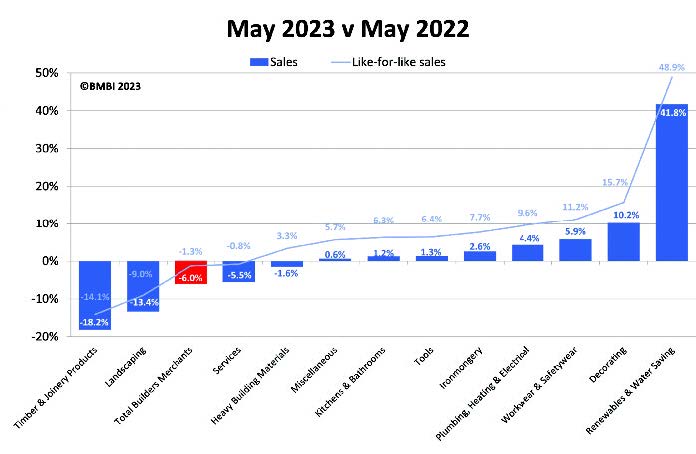

Year on Year

Total merchant sales were down -6.0% in May compared to May 2022. Volume sales fell -15.1% with price inflation of +10.8%. With one less trading day in May 2023, like-for-like sales were -1.3% lower. Eight of the twelve categories sold more this year than in May 2022. Renewables & Water Saving (+41.8%) grew the most, followed by Decorating (+10.2%) and Workwear & Safetywear (+5.9%). Heavy Building Materials (-1.6%), Landscaping (-13.4%) and Timber & Joinery Products (-18.2%) were all down year on year.

Total merchant sales in the twelve months from June 2022 to May 2023 were -0.3% lower than the same period a year ago, with volumes down -13.6% and price inflation of +15.4%. With five less trading days in the most recent period, like-forlike sales were +1.8% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+41.0%) outperforming the other categories by some margin. Workwear & Safetywear (+14.3%), Plumbing, Heating & Electrical (+12.2%), Decorating (+11.6%) and Kitchens & Bathrooms (+11.0%) also made double figures. Heavy Building Materials (+5.7%) grew more slowly. Landscaping (-10.4%) and Timber & Joinery Products (-13.6%) sold less. Gordon Parnell, sales director, British Gypsum and BMBI’s expert for drylining systems said: “In what was predicted to be a slower start to 2023, we are cautiously optimistic that confidence will begin to grow within our core markets over the coming months. “Demand across the principal sectors with which our products are typically aligned such as residential and RMI/ change of use has been weaker. In private housing, the lack of any further government stimulus in the spring budget alongside increasing mortgage rates and the end of schemes such as Help to Buy, has put further pressure on the residential sector. Housebuilders, however, report that demand is expected to recover after a slow start, albeit from that low base, and the recovery will be slow”.

Gordon Parnell, sales director, British Gypsum and BMBI’s expert for drylining systems said: “In what was predicted to be a slower start to 2023, we are cautiously optimistic that confidence will begin to grow within our core markets over the coming months. “Demand across the principal sectors with which our products are typically aligned such as residential and RMI/ change of use has been weaker. In private housing, the lack of any further government stimulus in the spring budget alongside increasing mortgage rates and the end of schemes such as Help to Buy, has put further pressure on the residential sector. Housebuilders, however, report that demand is expected to recover after a slow start, albeit from that low base, and the recovery will be slow”.

The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain.

Want to know more?

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.