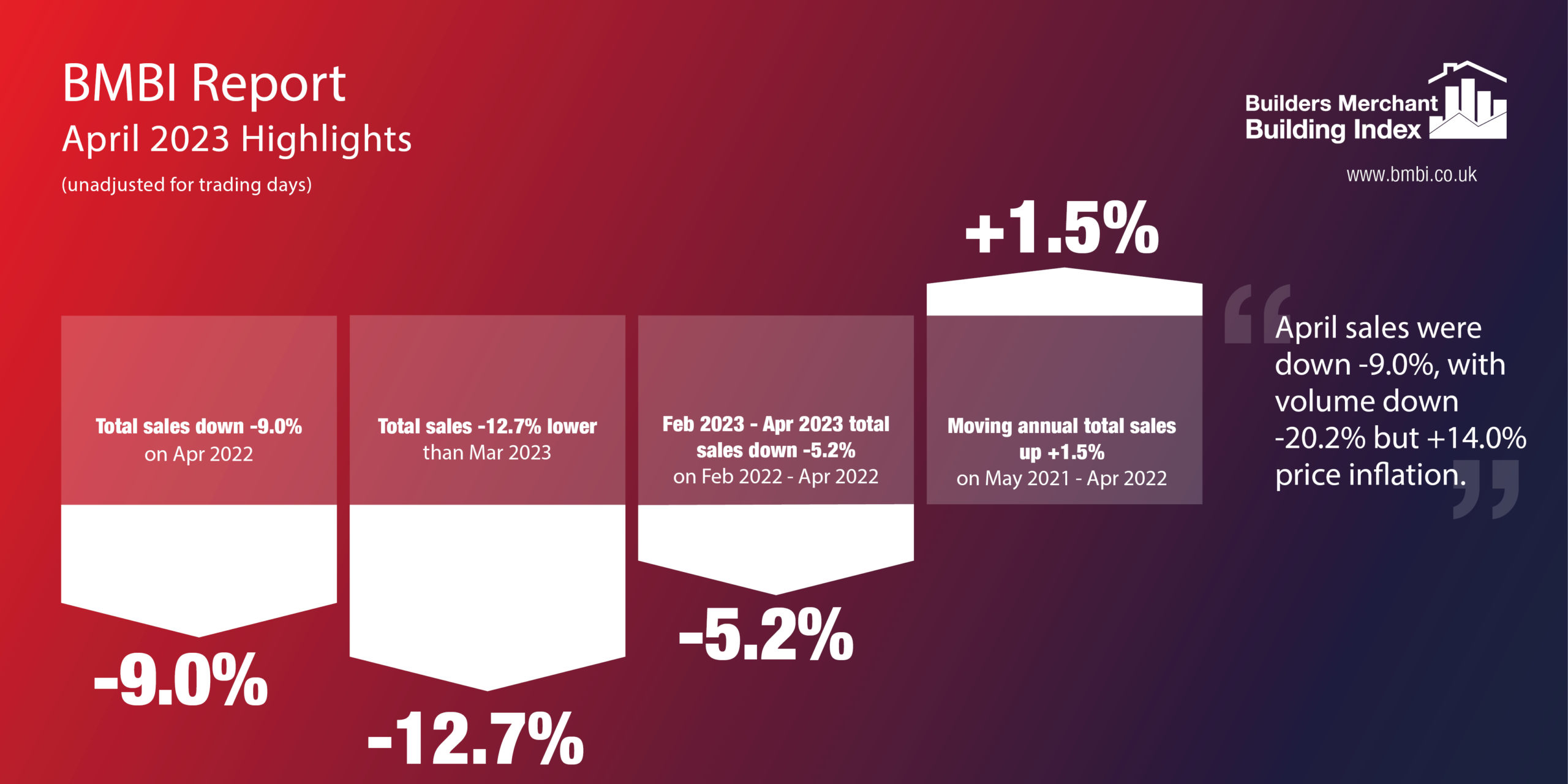

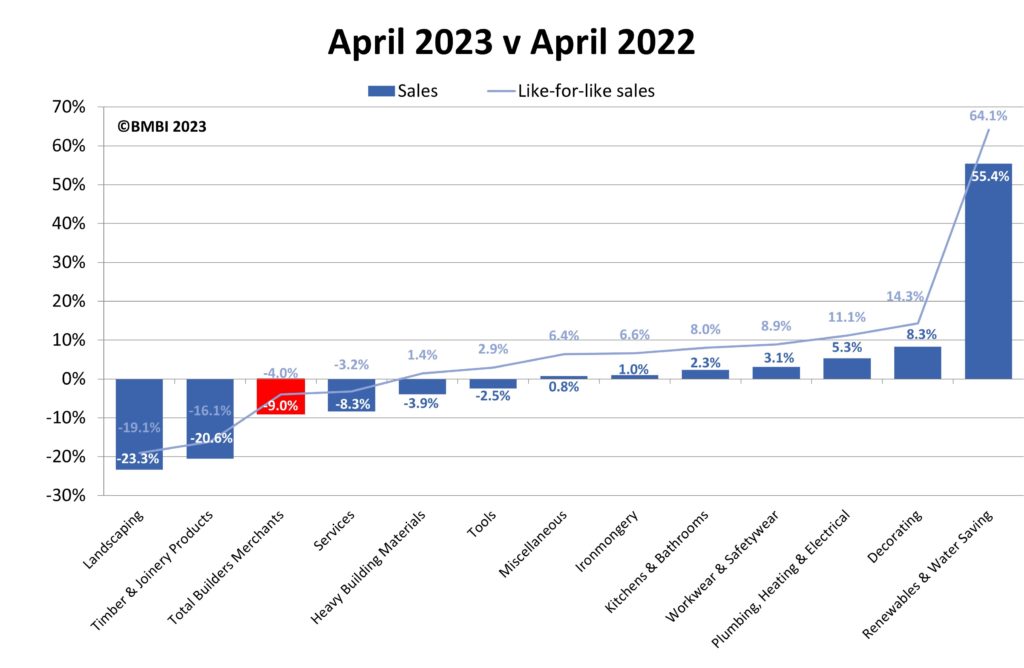

The latest figures from the Builders Merchant Building Index (BMBI), published in June, reveal that year-on-year value sales to builders and contractors by Britain’s builders’ merchants were down -9.0% in April 2023 compared to the same month in 2022. Volume fell -20.2% with price inflation of +14.0%. Taking trading day differences into account, like-for-like sales were -4.0% lower as April 2023 had one less trading day than the same month in the previous year.

Seven of the twelve categories sold more this year than in April 2022. Renewables & Water Saving (+55.4%) was the strongest performing category by some margin, while Decorating (+8.3%), Plumbing, Heating & Electrical (+5.3%) and Kitchens & Bathrooms (+2.3%) also fared better. Heavy Building Materials (-3.9%), Timber & Joinery Products (-20.6%) and Landscaping (-23.3%) all sold less.

Month on month

Total merchant sales were down -12.7% in April compared to March 2023. Volume sales were down -11.9% with prices registering a small decline (-0.9%). But with five less trading days in April, like-for-like value sales were up +11.6%. Plumbing, Heating & Electrical (-22.6%) and Workwear & Safetywear (-26.7%) were the worst performing categories. Landscaping (+3.3%) was the only category to sell more.

Rolling 12-months

Total merchant sales in the twelve months from May 2022 to April 2023 were +1.5% higher than the same period a year ago. Volumes fell -12.5% with price inflation of +16.0%. With two less trading days in the most recent period, like-for-like sales were +2.4% higher.

Krystal Williams, managing director at Pavestone and BMBI’s expert for natural stone and porcelain paving said: “High-end landscapers are reportedly busy, however those working in the mid to lower end of the market, where the cost-of-living increases are more keenly felt, are seeing a drop in demand. There is also an increasing disparity between budgets and aspirations – the upshot being will more people opt to DIY their patio to save on the labour element?“Paving product prices continue to fall thanks to the decrease in shipping costs, which are now back to pre-Covid levels. We didn’t see the usual ‘stock up’ preseason this year as merchants have been flushing through more expensive stock, bought when shipping prices were higher.

“Porcelain continues to grow in popularity while sandstone sales are rolling backwards. As a premium product with premium benefits, homeowners will pay more for porcelain. Disappointingly though, we are already seeing a race to the bottom on pricing and quality.

“We recently identified an issue with paving products mis-claimed as porcelain. This fake product is not fired at high enough temperatures, so it is porous, therefore susceptible to algae and staining, and it’s not scratch or slip resistant. To avoid a flood of unhappy customers returning when problems inevitably begin to surface, we are doing some education work around this growing issue, ensuring they are comparing apples with apples when making purchasing decisions.

“We recently identified an issue with paving products mis-claimed as porcelain. This fake product is not fired at high enough temperatures, so it is porous, therefore susceptible to algae and staining, and it’s not scratch or slip resistant. To avoid a flood of unhappy customers returning when problems inevitably begin to surface, we are doing some education work around this growing issue, ensuring they are comparing apples with apples when making purchasing decisions.

“Lighter colours are trending for 2023, including greige. We are offering a new porcelain with a marble pattern which is selling out fast, as customers seek out something different for their outdoor spaces.”

|

The Builders Merchant Building Index (BMBI) The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |