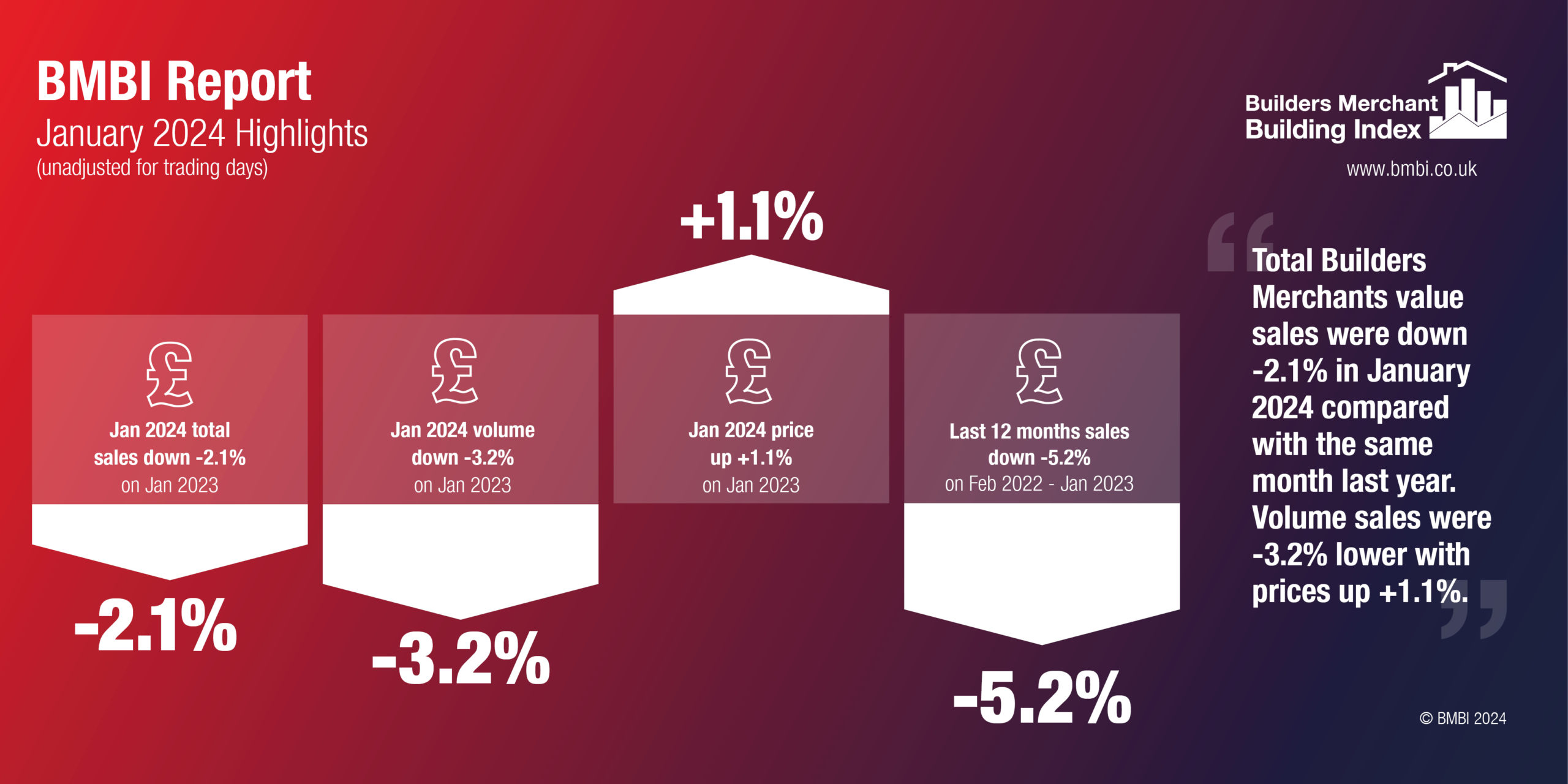

The latest figures from the Builders Merchant Building Index (BMBI), published in March, reveal that builders’ merchants’ value sales were down -2.1% in January compared to the same month in 2023, with volume sales falling -3.2% and prices creeping up +1.1%. With one more trading day this year, like-for-like sales were down -6.5%.

Year-on-Year

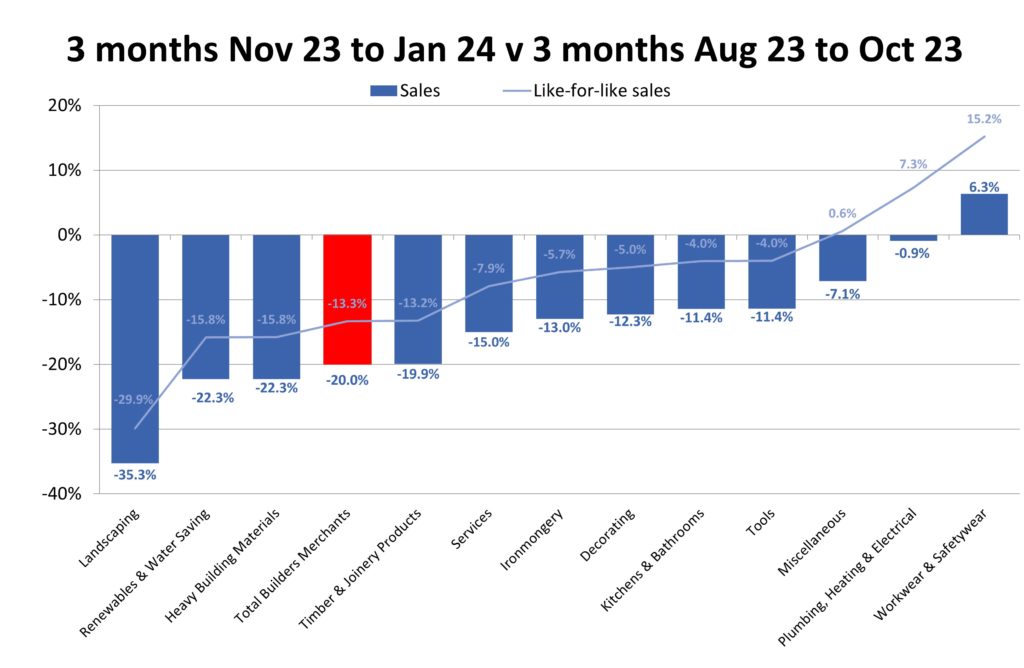

Nine of the twelve categories sold more this year than in January 2023 with workwear and safetywear (+18.3%), landscaping (+6.2%) and decorating (+6.1%) the better performers. However, falling sales in two of the largest categories impacted overall sales: heavy building materials (-3.8%) and timber and joinery products (-6.3%).

Month-on-month

Compared to a poor December 2023, total merchant sales in January were +41.2% higher month-on-month. Volume sales were up +44.2% while prices were down -2.1%. With six additional trading days in January, like-for-like sales increased +2.7%. All categories sold more including the largest three categories: landscaping (+52.2%), timber and joinery products (+43.8%), and heavy building materials (+42.5%). Services (+19.2%) grew the least.

Rolling 12 months

Rolling 12 months

Total merchant sales in the 12 months from February 2023 to January 2024 were -5.2% down on the same period the year before (February 2022 to January 2023). Volume sales were -12.9% lower and prices were up +8.8%. With two more trading days in the most recent 12-month period, like-for-like sales were -6.0% lower. Eight of the twelve categories sold more, with renewables and water saving (+20.6%) and decorating (+8.1%) the standout categories. Again, the three largest categories – heavy building materials (-3.7%), landscaping (-11.0%) and timber and joinery products (-13.9%) – sold less.

Ian Doherty, chief executive of Hexstone and the Owlett-Jaton brand, and BMBI’s expert for fastener and fixings said: “Subdued market conditions in both new construction and RMI has impacted directly on volumes in fasteners and fixings, with sales continuing to be down year-on-year. Compared to the previous two years, prices have continued to ease, with lower cost prices from the Far East and, until recently, lower shipping costs. With the majority of products being purchased in USD, the slight strengthening of GBP has also helped to keep prices down. All of these factors have contributed to a decline in the value of sales.

“However, events in the Red Sea may continue to have an impact in 2024. With the majority of shipping lines having diverted their Far East routings away from the more direct Red Sea and Suez Canal route, to the longer Cape of Good Hope route, there are impacts on cost price and supply. Shipping costs have had surcharges applied to reflect the longer passage and therefore more expensive route. But the longer route also has a marked impact on shipping capacity, and a previously 8-10 week return trip from the Far East to Europe will now take 12-14 weeks. This reduction in capacity, coupled with a growing imbalance in container availability, is resulting in shipping rates moving up which will feed into higher prices for fasteners and fixings.”

Want to find out more?

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, expert comments and round table videos, visit www.bmbi.co.uk.

| The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from 92% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |