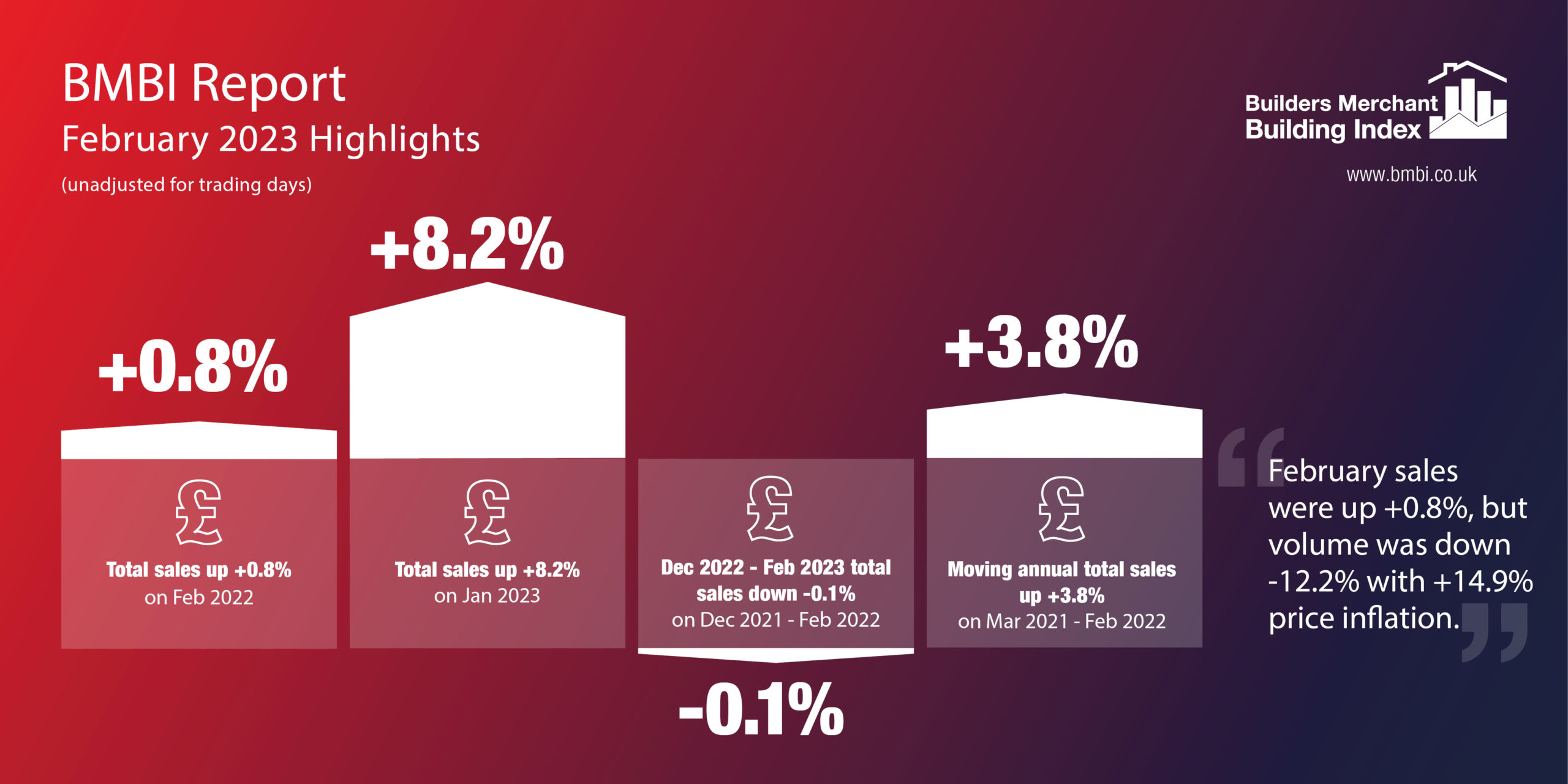

The latest figures from the Builders Merchant Building Index (BMBI), published in April, reveal that year-on-year value sales to builders and contractors by Britain’s builders’ merchants were up +0.8% in February compared to the same month in 2022. This growth was driven exclusively by price inflation (+14.9%) as volume sales fell -12.2%. There was no difference in trading days.

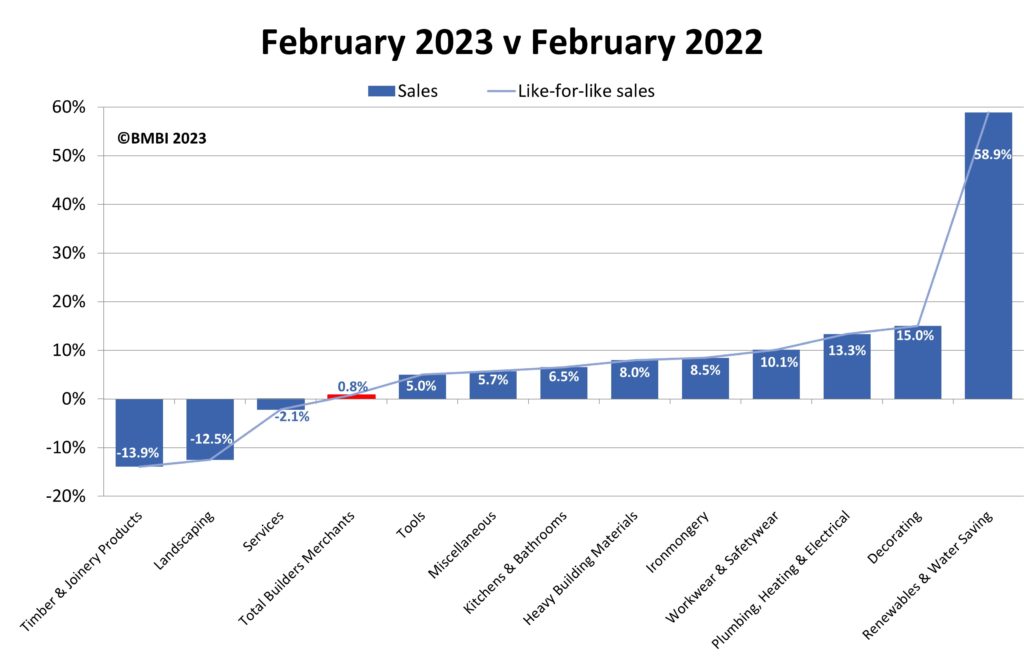

Nine of the twelve categories sold more in February 2023 compared to February 2022. Renewables & Water Saving (+58.9%) was again the strongest performing category, while Decorating (+15.0%), Plumbing, Heating & Electrical (+13.3%), Workwear & Safetywear (+10.1%) and Ironmongery (+8.5%) also increased. Heavy Building Materials (+8.0%) grew more slowly, while Timber & Joinery Products (-13.9%), Landscaping (-12.5%) and Services (-2.1%) all sold less.

Month on month

Total merchant sales were +8.2% higher in February 2023 than the previous month. Volume sales were +13.4% higher than January, while prices were down -4.6%. With one less trading day in February, like-for-like sales were up +13.6%. Month-on-month the strongest category was Landscaping (+27.6%), followed by Heavy Building Materials (+10.9%). Workwear and Safetywear (-6.5%) was the weakest performing category.

Rolling 12-months

Total merchant sales in the twelve months from March 2022 to February 2023 were +3.8% up on the same period a year ago. Price inflation reached +16.6% while volumes were down -11.0%. With two less trading days in the most recent period, like-for-like sales were +4.7% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+35.0%) continuing to lead the field. Kitchens & Bathrooms (+16.1%), Plumbing, Heating & Electrical (+14.6%), Workwear & Safetywear (+13.8%), Decorating (+11.5%) and Heavy Building Materials (+9.5%) all did better than merchants overall. Landscaping (-5.1%) and Timber & Joinery Products (-7.6%) both sold less.

Derrick McFarland, managing director Keystone Group UK and BMBI’s expert for steel lintels said: “Red flags are everywhere. Lots of companies have already provided cost of living contributions to support their valued staff and more increases will be required to support them during 2023. Unless households have plenty of spare cash, large purchases such as extensions and renovations will be delayed. National house builders have all reported new house sales down around 30% in Q4, which for lintels will mean a quiet Q2 2023. It will take time for interest rate increases, house price levels and mortgage competitiveness to settle, and the outlook is subdued.

Manufacturers will be seeing material prices stabilise, but over recent years have only recovered material hikes while other inflationary costs continue to pressure that very cost base. Merchants who enjoyed significant pound-note earnings on the back of material increases will no doubt be competing harder for smaller volumes”.

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

|

The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |