The latest figures from the Builders Merchant Building Index (BMBI), published in October, reveal that builders’ merchants’ value sales were down -3.3% in the month of August compared to the same month in 2022, with volume falling -10.5% and prices up +8.0%.

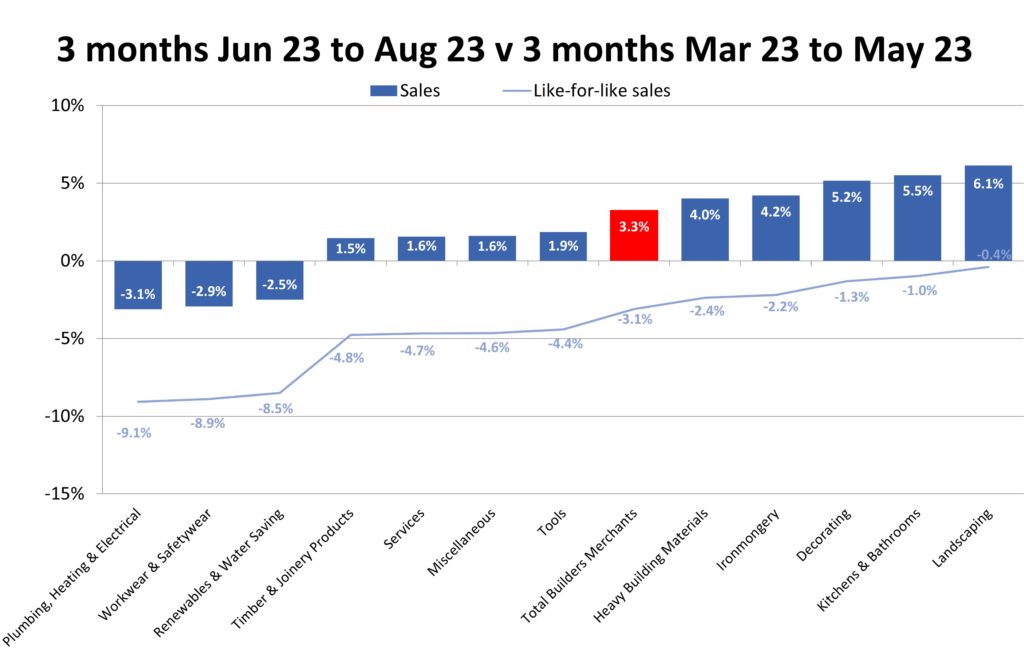

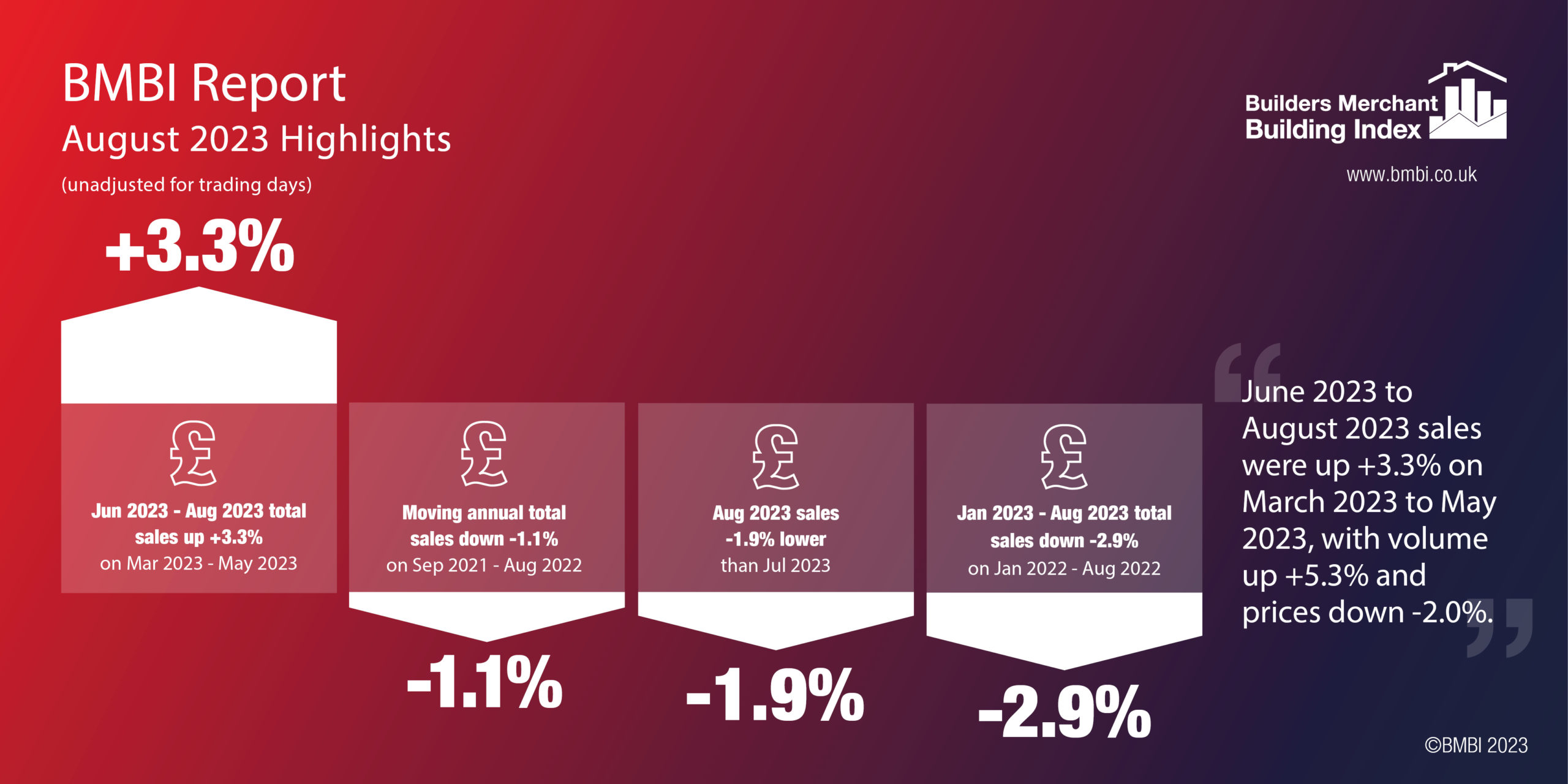

But value sales in the last three months, June to August, were +3.3% higher than March to May 2023 with volume up +5.3% and prices down -2.0%.

Eight of the twelve categories sold more this August than in August 2022 with renewables and water saving (+37.6%) continuing to dominate the field. Workwear and safetywear (+11.6%); plumbing, heating and electrical (+10.8%) and decorating (+10.8%) increased more than other categories. Heavy building materials value sales dropped slightly (-1.3%) while landscaping (-7.0%) and timber and joinery products (-13.2%) were weakest.

Total merchant sales were down -1.9% in August compared to July. Volume sales were down -3.2% while prices increased +1.4%. With one additional trading day in August, like-for-like sales were -6.3% lower. Five of the twelve categories sold more, led by workwear and safetywear (+7.5%). Heavy building materials (-2.3%) was one of the seven categories to sell less. Renewables and water saving (-9.6%) was the weakest performing category.

Rolling 12-months

Total merchant sales in the twelve months from September 2022 to August 2023 were -1.1% down on the same period a year ago, with volumes falling -12.8% and prices up by +13.3%. Nine of the twelve categories sold more with renewables and water saving (+46.0%) the best performer by a considerable margin. Plumbing, heating and electrical (+13.2%); decorating (+13.0%) and workwear and safetywear (+12.5%) also recorded double digit growth. Heavy building materials (+3.8%) grew more slowly. Landscaping (-10.9%) and timber and joinery products (-14.0%) both sold less. Mathew Whitehouse, marketing director, Bostik UK, and BMBI’s expert for adhesives and sealants said: “The true extent of the slowdown in building activity was revealed when it was reported that new home registrations were down 42% in Q2 compared to the same period last year: perhaps not too surprising with interest rates hitting a 15 year high.

Mathew Whitehouse, marketing director, Bostik UK, and BMBI’s expert for adhesives and sealants said: “The true extent of the slowdown in building activity was revealed when it was reported that new home registrations were down 42% in Q2 compared to the same period last year: perhaps not too surprising with interest rates hitting a 15 year high.

“The Government has announced a renewed focus on unblocking the planning system in a bid to meet its manifesto commitment to build one million homes over this Parliament, but I struggle to see that there will be an improvement in the number of completions until there’s a significant fall in inflation and mortgage rates are eased.

“On a more positive note, a shortage of quality housing in the UK means the long-term outlook for the adhesives and sealants sector remains positive.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

| The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |