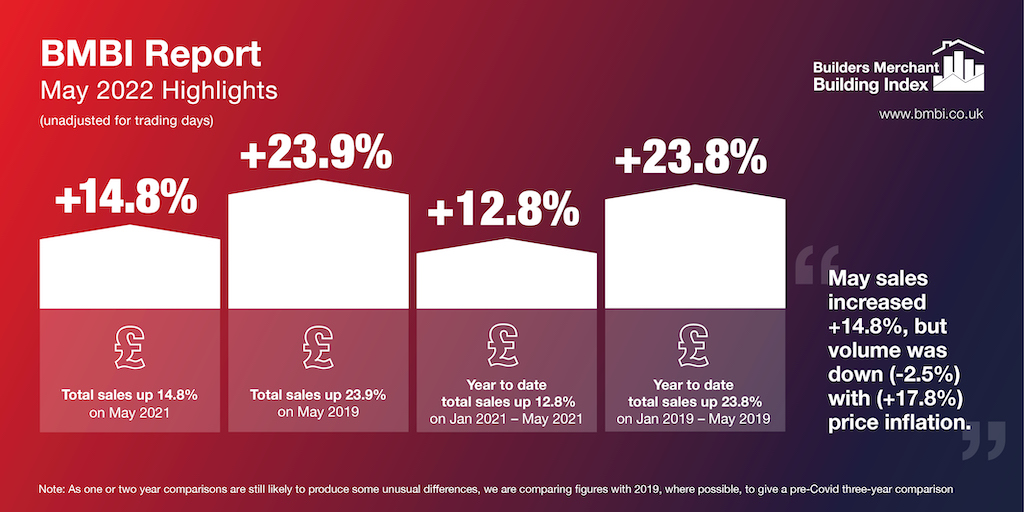

Figures from the Builders Merchant Building Index (BMBI), published in July, reveal that year-on-year value sales to builders by Britain’s builders’ merchants were up +14.8% compared to the same month in 2021, driven more by rising prices (+17.8%) than volume sales, which were down -2.5% year-on-year.

All categories sold more in May 2022 compared to the previous year, with Kitchens & Bathrooms increasing the most (+29.7%). Six other categories fared better than merchants overall including Plumbing, Heating & Electrical (+21.6%), Heavy Building Materials (+20.6%) and Decorating (+16.5%). Tools (+11.9%), Ironmongery (+11.3%), Timber & Joinery Products (+6.8%) and Landscaping (+5.1%) grew more slowly. Like-for-like sales, which take into account the extra trading day in May 2022, were 9.1% higher.

Compared to May 2019, a more normal pre-pandemic year, total merchant value sales were 23.9% higher with one less trading day in the most recent period. All categories sold more, with three outperforming total merchants: Renewables & Water Saving (+50.8%), Timber & Joinery Products (+36.8%) and Landscaping (+33.0%). Like-for-like sales were up +30.1%, while price inflation hit +30.0% and volumes were down -4.7%.

Month-on-month

Month-on-month, total merchant sales were +8.7% up in May compared to April 2022, with one more trading day this year. All categories sold more, including Heavy Building Materials (+10.5%) and Kitchens & Bathrooms (+10.0%). Like-for-like sales were +3.3% up.

Rolling 12-months

Total Merchants sales in the 12 months June 2021 to May 2022 were 15.7% higher than in the same 12 months a year earlier, with one less trading day in the most recent period. Total like-for-like sales were 16.2% higher.

With price inflation of +15.7%, volume was effectively flat (+0.02%). Eleven of the twelve categories sold more. Timber & Joinery Products (+27.0%) grew most while Plumbing, Heating & Electrical (+15.0%), Heavy Building Materials (+13.6%) and Landscaping (+6.1%) all grew more slowly. Only Workwear & Safetywear (-1.1%) sold less.

Derrick McFarland, Managing Director Keystone Group UK and BMBI’s Expert for Steel Lintels commented: “Russia’s invasion of Ukraine has added a whole new set of problems to global supply chains which were still reeling from the effects of the pandemic. Russia, Ukraine, and Belarus account for almost one quarter of finished steel imports into the EU & UK, and 80% of the region’s imports of semi-finished steel.

“The war and the sanctions applied against Russia and Belarus have further choked the flow of vital resources for steel supply and manufacturing. We are also seeing spiralling costs, as well as disrupted supply lines. Prior to Russia’s invasion, steel producers were already lifting prices due to higher costs, particularly for energy.

“Lockdowns in Shanghai, the world’s largest container port, and US ports continually plagued by industrial labour disputes, are hitting global trade, with further disruption to maritime shipping expected for up to 12 months.

“Availability so far in 2022 is back to what we’d expect in more normal times, albeit at significantly higher prices. Lead times are still extended, but the supply is currently smoother.

“The only clear good news is that the new building regulations are imminent, bringing with it a chance for energy saving products to shine.”