January merchant sales marginally up but volumes still down year-on-year

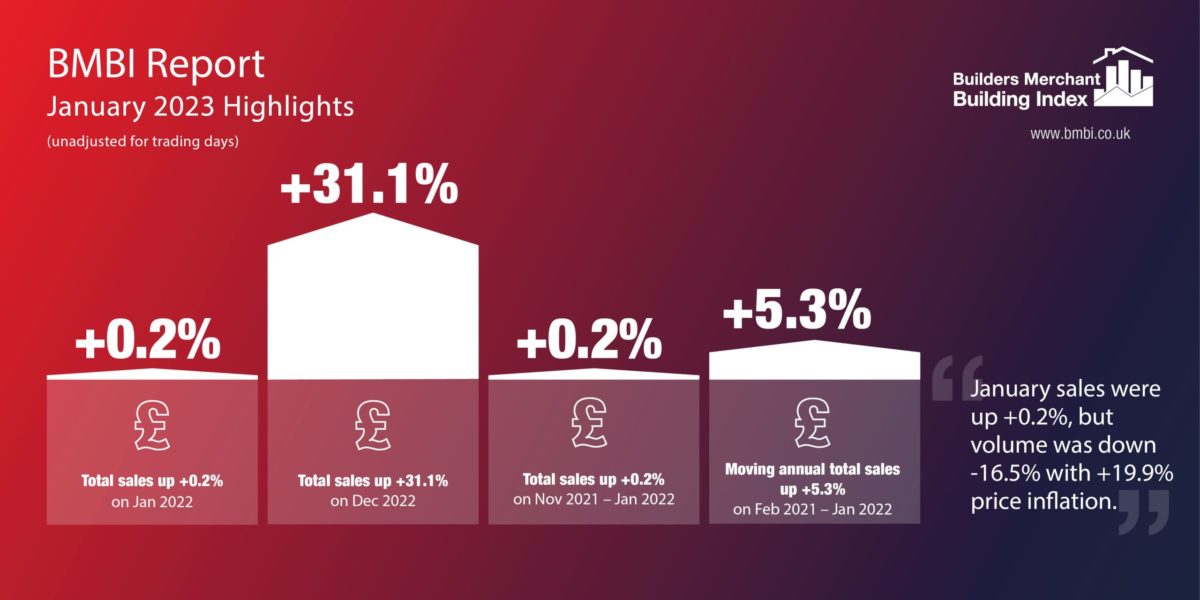

The latest figures from the Builders Merchant Building Index (BMBI), published in March, reveal that year-on-year value sales to builders and contractors by Britain’s builders’ merchants were up +0.2% in January 2023 compared to the same month in 2022. This nominal growth came from inflation as volume sales were down -16.5% while prices rose +19.9%. With an extra trading day this January, like-for-like sales were -4.6% lower.

Nine of the twelve categories sold more in January compared to the previous year. Renewables & Water Saving (+46.0%) continued to perform strongly, while Decorating (+20.5%), Plumbing, Heating & Electrical (+17.5%), Workwear & Safetywear (+14.4%) and Kitchens & Bathrooms (+12.4%) also did better than overall sales. Heavy Building Materials grew more slowly (+4.8%). Timber & Joinery Products (-14.6%), Landscaping (-11.8%) and Services (-0.5%) all sold less.

Month on month

Month-on-month, total merchant sales were +31.1% higher in January 2023 than seasonal low month, December 2022. Volume sales also grew (+28.6%) with price slightly up (+1.9%). With five more trading days in January, like-for-like sales were flat (-0.1%). Renewables & Water Saving (+49.6%) grew the most, followed by Ironmongery (+38.0%), while Decorating (+34.6%), Timber & Joinery Products (+33.9%) and Heavy Building Materials (+32.2%) also performed well.

Rolling 12-months

Total merchant sales in the twelve months from February 2022 to January 2023 were +5.3% up on the same period a year before. Price inflation was a double digit +16.5% while volumes were down -9.6%. With two less trading days in the most recent period, like-for-like sales were +6.2% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+32.5%) and Kitchens & Bathrooms (+17.7%) the standout categories. Decorating (+11.4%) and Heavy Building Materials (+10.5%) also did netter than merchants overall. Timber & Joinery Products (-5.0%) and Landscaping (-2.5%) sold less.

Ian Doherty, Chief Executive of Hexstone, and the Owlett-Jaton brand and BMBI’s Expert for Fastener & Fixings said: “The introduction of the UK’s own UKCA mark has continued to be a vexed issue for fasteners and fixings. Along with other building products, they fall under the Construction Products Regulations. UKCA replaces the European CE mark, which indicates that products for sale conform with all necessary safety, technical, and performance requirements.

“In December, new advice was issued by the Department for Levelling Up, Housing and Communities (DLUHC). This advice differed markedly from the previous advice, but the good news is that CE will continue to be recognised on CPR products until the end of June 2025, removing any shorter-term concerns about availability of products which meet regulations.”

Emile van der Ryst, Key Account Manager – Trade & DIY, GfK, which compiles the data for the BMBI report, added: “Due to market turmoil in 2022, some of the monthly figures need further context. This month is affected by Heavy Building Materials, Timber & Joinery and Landscaping distorting the total market view.

“These three categories make up around 75% of total market value and heavily influence topline trends but they are each quite different. Heavy Building Materials has one of the lowest average prices of the categories but has seen larger than market average price growth. Timber & Joinery has one of the highest average prices, but has seen lower than market average volume declines, with prices declining against rampant total market inflation. Finally, Landscaping is a key volume driver in the market, but has seen a larger than market average seasonal volume decline. These factors in combination occasionally create hard-to-understand distortions, unexpected anomalies in topline trends which need to be seen in context.”

WANT TO KNOW MORE?

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.