Consumer research by fixed fee estate agent, eMoov.co.uk, has revealed what UK homeowners believe add the most financial value to a home during the selling process.

eMoov surveyed over 1,000 UK homeowners in October 2015 asking them what they think adds the most financial value when looking to purchase a property.

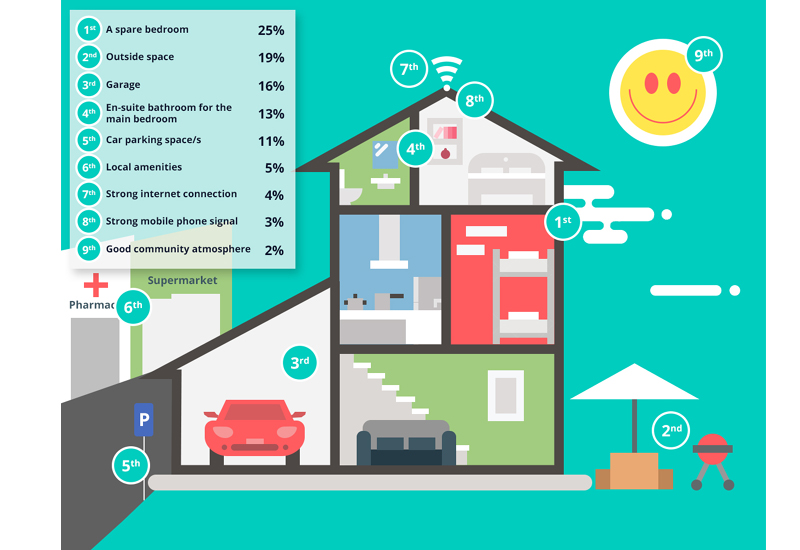

Topping the list was a spare bedroom, with 25% of those asked believing an additional bedroom adds the most value to a property. The appeal of the spare room stretches far beyond its use as an extra place to sleep and can be utilised in many ways whether it be a home office, salon, nursery, workshop or play room.

Outside space was the next best justification for a higher property price, with 19% of homeowners believing it added the most value. The garage was the third best asset a homeowner’s property can include, with 16% of those asked thinking it added the most financial value.

Just 2% of those asked felt a good community atmosphere added value to a property.

|

Rank |

Will add the most financial value | % of Homeowners |

| 1st | A spare bedroom | 25% |

| 2nd | Outside space | 19% |

| 3rd | Garage | 16% |

| 4th | En-suite bathroom for the main bedroom | 13% |

| 5th | Car parking space/s | 11% |

| 6th | Local amenities such as a supermarket, doctors surgery | 5% |

| 7th | Strong internet connection | 4% |

| 8th | Strong mobile phone signal | 3% |

| 9th | Good community atmosphere | 2% |

Founder and CEO of eMoov.co.uk, Russell Quirk, commented: “This research goes to show that it’s the fundamentals people are concerned about, the number of bedrooms in case they want friends to stay or wish to start a family, outside space to entertain or for the kids to play in, a garage to store that accumulated clutter as the years pass by, an en-suite so you can have a bath in peace or that extra parking space for when the 17th birthday rolls round.”