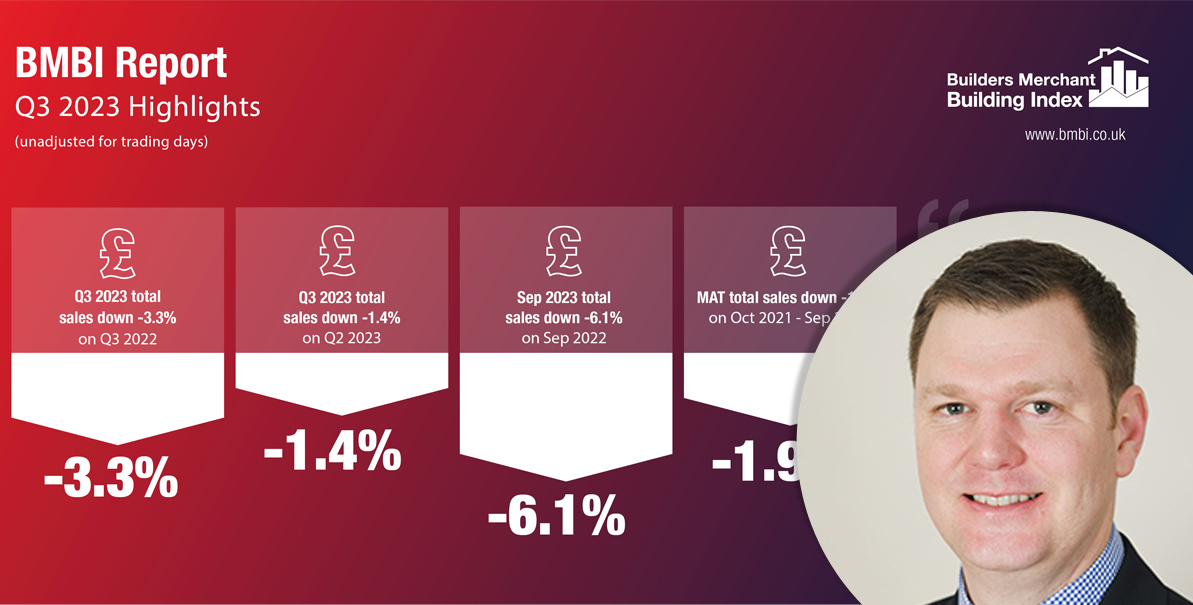

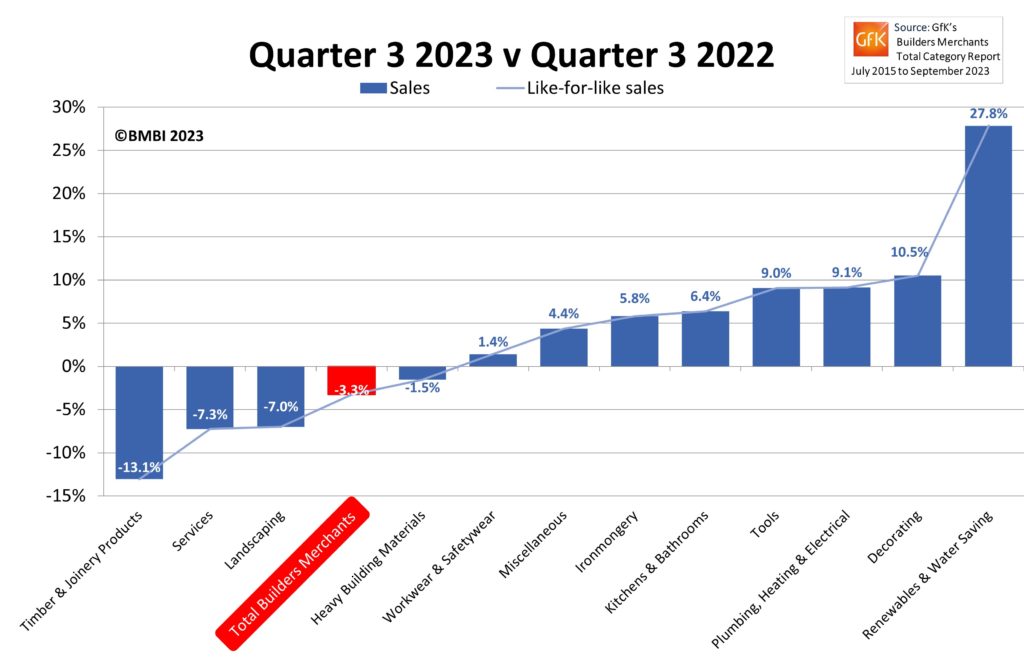

The latest total volume sales from Britain’s builders’ merchants reported by BMBI showed Q3 2023 volumes fell -10.5% compared to the same period in 2022. With prices rising +8.0%, total value sales were down -3.3%. There was no difference in trading days.

Year-on-year, eight of the twelve categories sold more with Renewables & Water Saving (+27.8%) once again significantly ahead of the rest. The three largest categories all sold less: heavy building materials (-1.5%), landscaping (-7.0%) and timber & joinery products (-13.1%).

Quarter-on-quarter, total value sales dipped -1.4% in Q3 compared with April to June 2023. Volume sales dropped -2.1% and prices edged up +0.8%. With four more trading days in the most recent period, like-for-like sales were -7.5% lower in July to September compared to Q2.

Q3 results weren’t helped by September total value sales, which were -6.1% down on the same month in 2022, with no difference in trading days. Volume sales fell -13.0% while prices rose +7.8%. Value sales of the largest three categories, heavy building materials (-5.8%), landscaping (-6.7%), and timber & joinery products (-13.9%), were significantly down, although some smaller categories, tools (+7.4%), decorating (+7.3%), kitchens & bathrooms (+5.9%), plumbing, heating & electrical (+3.3%) and ironmongery (+1.7%), sold more.

September total merchant sales were down -3.4%. Volume (-2.7%) and price (-0.7%) were also down. With one less trading day in September, like-for-like sales were +1.2% higher. Only three categories sold more: work- & safetywear (+2.7%), plumbing, heating & electrical (+2.3%) and kitchens & bathrooms (+0.8%). Seasonal category landscaping (-9.2%) contracted the most.

Jim Blanthorne, managing director of Keylite Roof Windows and BMBI’s expert for roof windows commented: “Lower market demand seems to be a result of reduced consumer confidence while relatively high interest rates and inflation levels cause many to put on hold their plans to move or improve. Quarter three therefore brought reduced activity levels which is unlikely to improve in the near term.

“One upside of lower volumes is that supply chains have now fully normalised and availability of primary raw materials and sub-components is no longer a routine concern, with the exception of a new challenge regarding timber certification.

“For the past decade, we have sourced FSC material, however most Polish forestry regions and mills have decided to terminate their FSC accreditation over frustration with new compliance requirements which have been perceived by some to be well beyond the scope of ensuring chain of custody.

“Most mills have now secured PEFC certification instead which is equally well regarded and continues to ensure that the timber we use comes from responsibly managed sources.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk.

| The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk. |