Limited residential land supply is creating fierce competition among UK housebuilders.

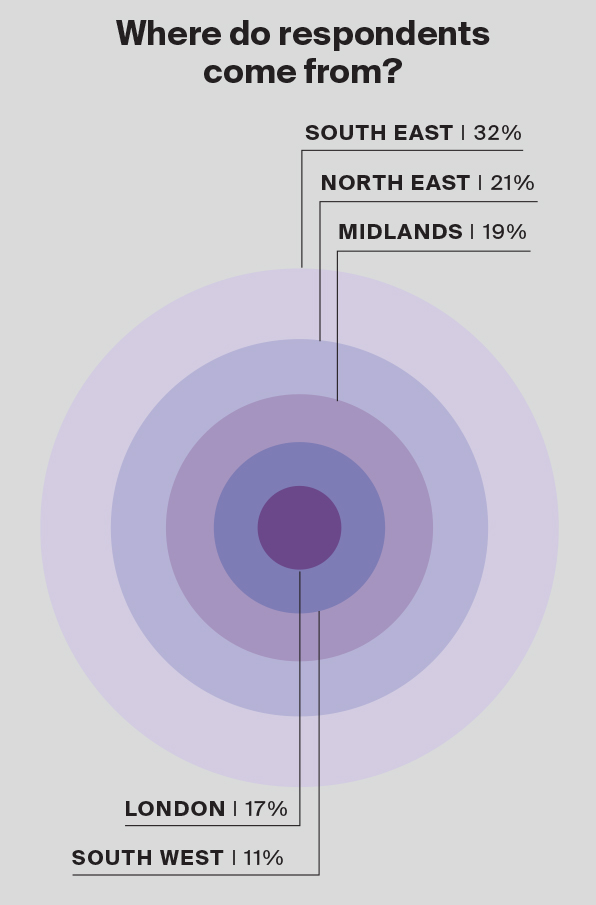

Global property consultancy Knight Frank has announced the results of a new survey it has conducted among nearly 50 volume and SME housebuilders based across England. According to the new report, land supply shortages, planning delays and policy uncertainty top the list of barriers to delivery faced by UK housebuilders.

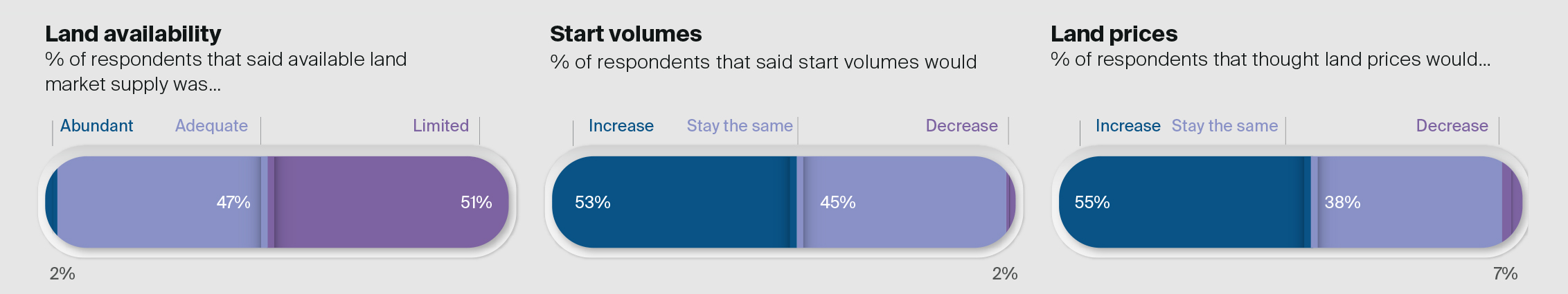

Over 50% of those surveyed by Knight Frank said that residential land supply was ‘limited’, while only 2% of respondents felt land was ‘abundant’.

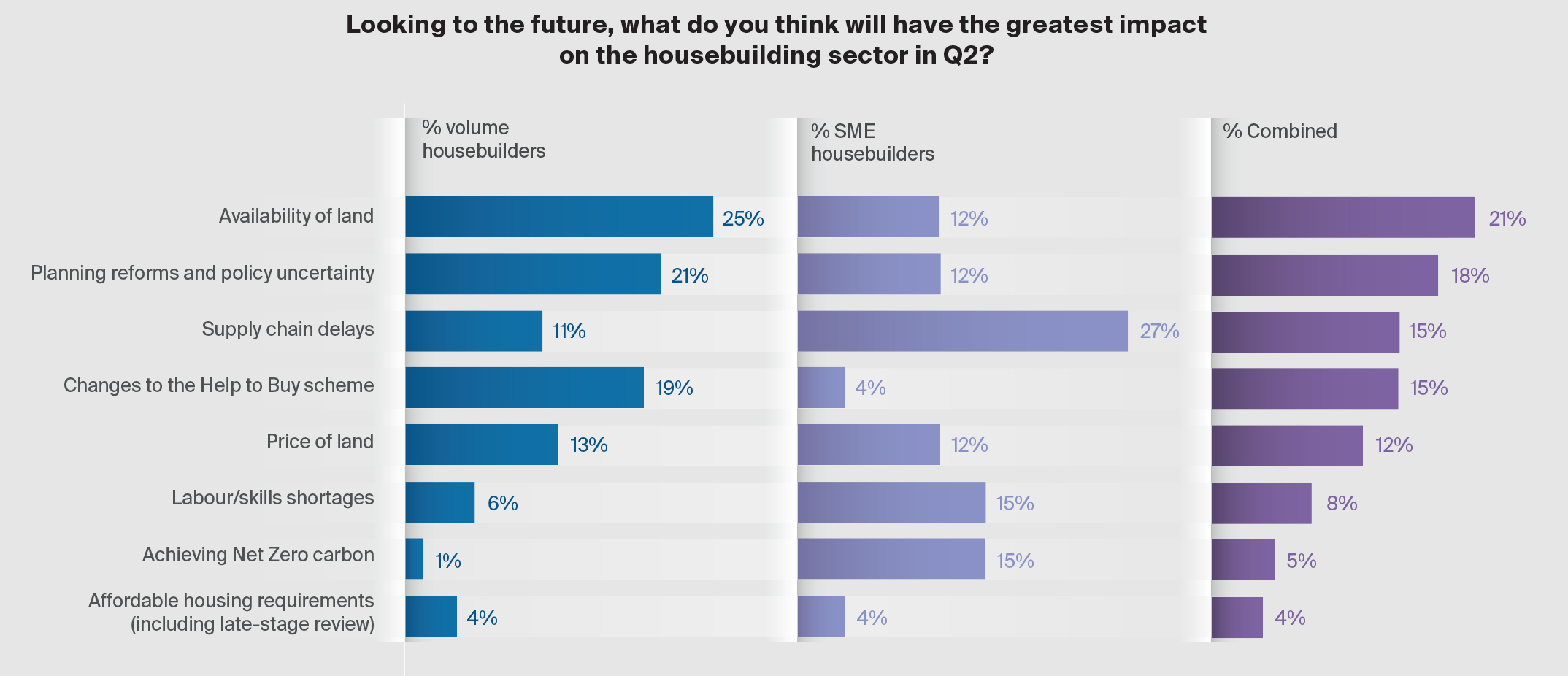

When asked about the most pressing issues for the industry over the next three months, 21% selected ‘availability of land’, 18% said ‘planning reforms and policy uncertainty’ and 15% selected ‘supply chain delays’.

For 19% of larger housebuilders, changes to the Help to Buy scheme will be another key area of focus for Q2, along with availability of land and planning reform.

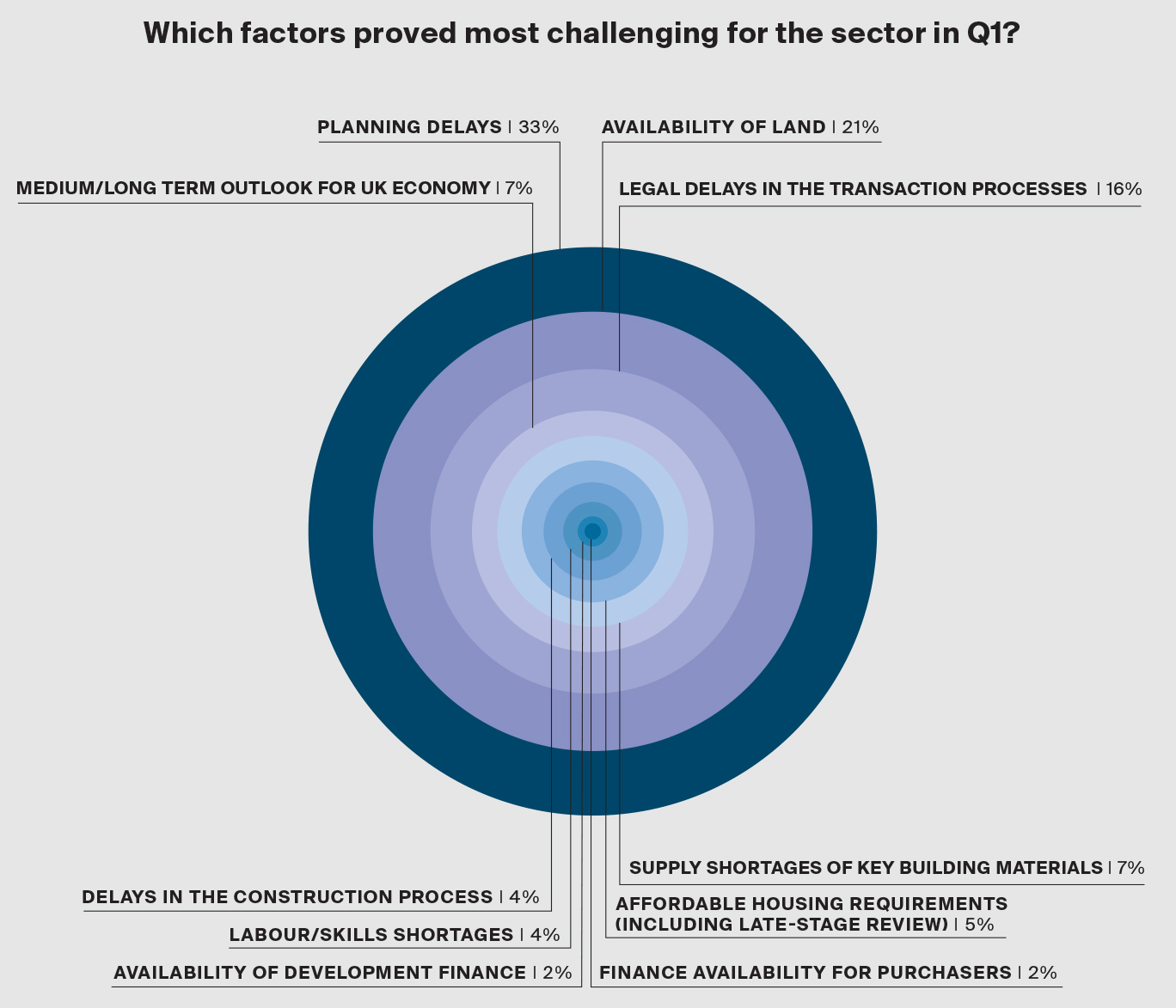

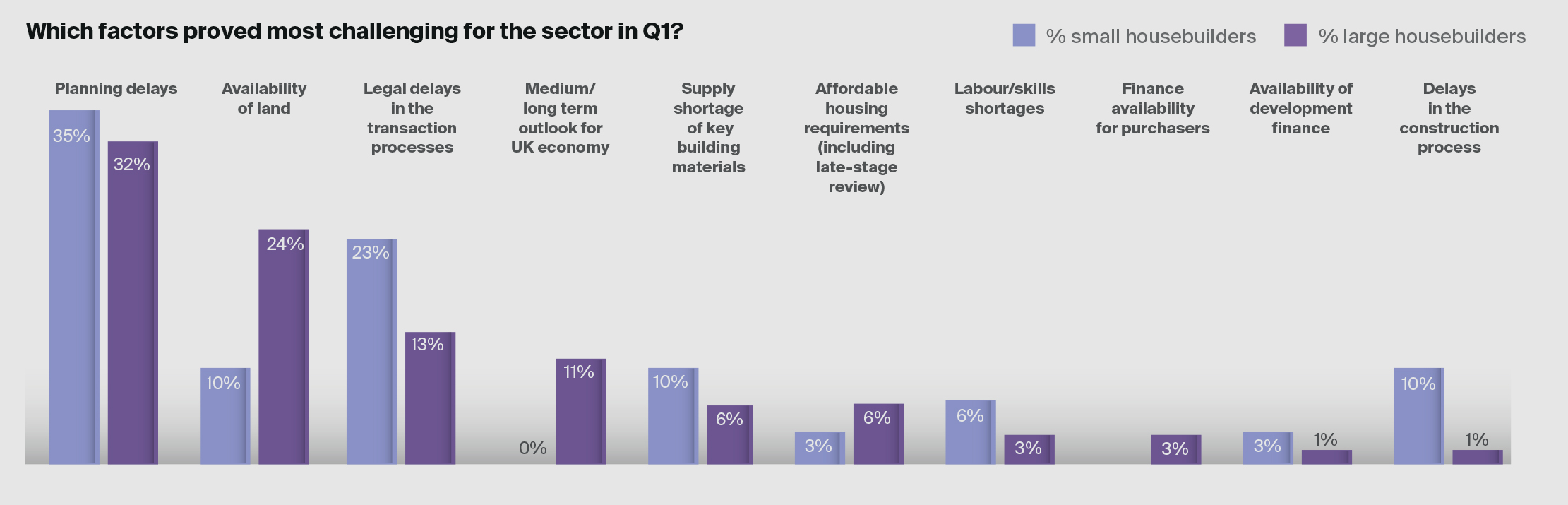

In Q1, a third of all respondents pointed to ‘planning delays’ being a challenging factor, 21% selected ‘availability of land’, while just 7% said the medium to long term outlook for the UK economy had been an issue.

Land supply shortages are leading to an expectation that prices will rise. When asked about land values, 55% of Knight Frank’s survey respondents said that they thought prices would increase in Q2, with 38% saying they would stay the same and only 7% anticipating a decrease.

Justin Gaze, Head of Residential Development Land at Knight Frank, said: “We are seeing a sense of normality return to the market for the first time since the pandemic struck. New sites are quickly going under offer at the top end of our price expectations, and there is a severe lack of land availability for both medium and larger schemes. So much so that we’re seeing housebuilders being increasingly competitive in order to compete on sought-after sites of 50-units and above.”

In the first quarter of 2021, urban brownfield and greenfield land values both grew by 0.2% and 0.9% respectively between January and March 2021, according to Knight Frank’s Q1 2021 Residential Land Index.

However values were lower on an annual basis, with greenfield development land falling 4.8% and urban brownfield land falling 2.2% compared to 2020. Prime Central London values remained flat – both this quarter and compared to the previous year.