UK housing land values have remained stable against an uncertain economic and political backdrop, says Patrick Eve, Savills head of Regional Development.

Housing land values remained stable during the second quarter of 2019 against a backdrop of rising Brexit-fuelled political and economic uncertainty and a lack of clarity over future housing policy, according to the latest analysis from international real estate adviser Savills.

Risk mitigation and margin discipline continue to be the guiding principles for housebuilders when buying land, but smaller, uncomplicated sites in attractive locations are commanding strong interest, particularly in markets still seeing strong house price growth.

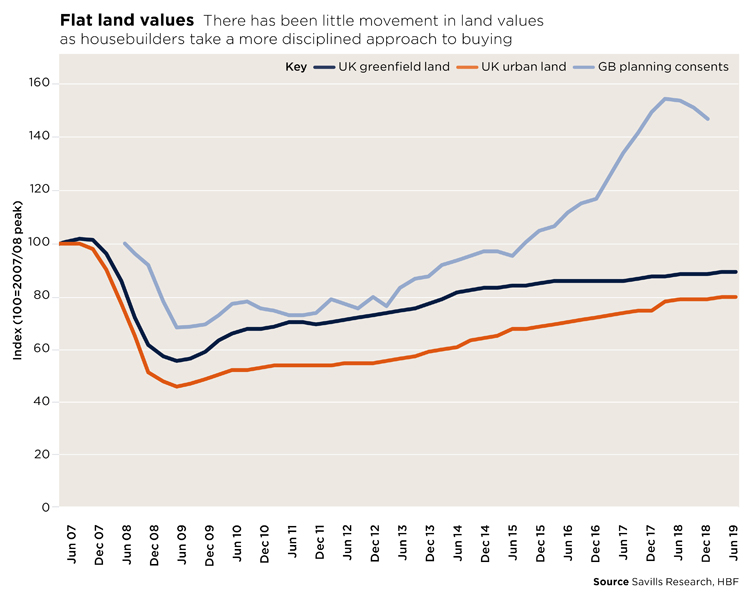

UK greenfield and urban residential development land values saw no change in the second quarter, leaving annual growth at 0.8% and 0.6% respectively. In contrast to the rest of the UK, where values remained virtually unchanged, land values in Scotland and the East saw price growth in the second quarter.

In Scotland, values were driven by a shortage of land opportunities in key Scottish cities, while values across the broader eastern region (East Midlands and East of England) where pushed up by a combination of strong rates of new home sales in the East Midlands, and competition for sites for around 100 homes on the edge of relatively affordable, well-connected urban locations such as Peterborough and Derby.

Caution has dictated the pace of the housing land market across much of the UK for the past two years and that won’t change until there is greater political and economic certainty. This is an inevitable industry response not only to Brexit, but also the announced restrictions and eventual withdrawal of Help to Buy, as well as the cyclical slowing of the housing market, which is particularly pronounced in London and the south of England.

There are signs that this is feeding into a wider slowdown in housebuilding. Latest available MHCLG figures point to a slowdown in total new build starts across England, which were down 9.0% in the first quarter of 2019 compared to the same period in 2018. Private new build starts were down 11%. At the same time, housebuilders are looking to alternative sources of delivery, such as build to rent, with Telford Homes the most prominent mover into this sector.

A more selective approach to land buying by housebuilders is clear. The industry has benefitted from the significant increase in planning consents over the last six years, but new consents peaked in 2018 as housebuilders began to draw from their permissioned pipeline.

Housing associations and local authorities

Housing associations are increasingly important players in the land market, with the potential – and in many cases, the stated ambition – to deliver significantly more new homes both on their own or through joint ventures and partnerships. However, while 78% of respondents in the Savills Housing Sector Survey (May 2019) pointed to an appetite for land acquisition – citing land availability as the biggest constraint to development – uncertainty over future policy support for the sector is increasing risk aversion.

Local authorities also have ambitions to develop at scale following the lifting of the HRA debt cap. According to the Savills survey, 70% of respondents aim to increase delivery, a quarter planning a ‘significant’ increase. Again, clarity over housing policy is needed to unlock this potential demand for development land.