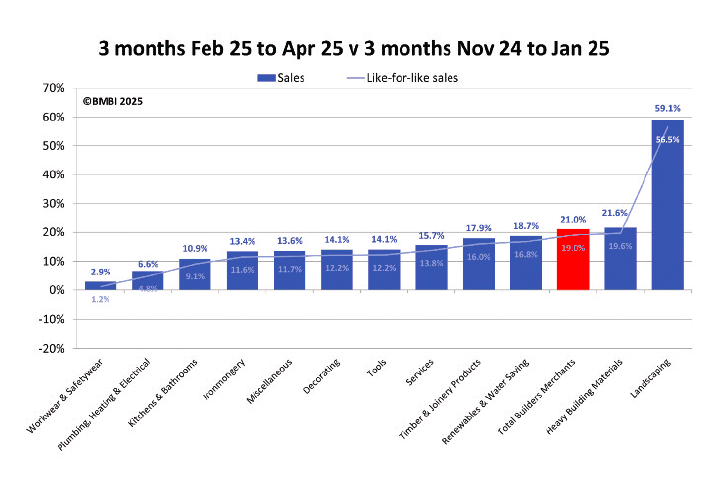

The latest Builders Merchant Building Index (BMBI) report, published in June, shows builders’ merchants’ value sales in April were up +3.0% compared to April 2024. Volumes increased +3.4% year-on-year, while prices eased -0.3%. With one less trading day in the most recent period, like-for-like value sales – which take trading day differences into account – were up +8.2%.

Year-on-Year

Seven of the twelve categories sold more compared to April last year, with seasonal category Landscaping (+13.3%) well ahead of the rest. Workwear & Safetywear (+8.7%), Miscellaneous (+5.3%) and Heavy Building Materials (+3.7%) performed well. Timber & Joinery Products (+1.7%) also sold more but less than Total Merchants. The weakest categories were Decorating (-3.3%) and Plumbing Heating & Electrical (-3.9%).

Month-on-month

Value sales in April were +0.9% above the previous month’s sales. Month-on-month, volume sales were flat at -0.2%, and prices increased +1.0%. Just four categories sold more compared to March, with Landscaping (+15.6%) and Workwear & Safety (+6.0%) ahead the most. The two largest categories – Timber & Joinery Products (+0.7%) and Heavy Building Materials (+0.1%) -– sold more but underperformed compared to Total Merchants. Decorating was down – 3.2%. With one less trading day in April, likefor- like value sales were +5.9% up.

Latest 12 months

Total value sales in the 12 months May 2024 to April 2025 were down -2.3% on the previous 12-month period (May 2023 to April 2024). Volume sales dropped – 1.5% and prices were -0.8% lower. Five of the twelve categories sold more with Workwear & Safetywear and Tools (both +5.3%) out in front, followed by Services (+3.5%), Miscellaneous (+0.8%) and Landscaping (+0.2%). Timber & Joinery Products (-4.2%) and Heavy Building Materials (-2.6%) declined more than Total Merchants. Decorating slipped -1.0%, while Renewables & Water Saving (-16.4%) was the weakest category.

Paul Edworthy, Commercial Lead: Builders Merchant Group, Dulux Trade and BMBI’s Expert for Paint commented: “The paint industry was initially optimistic about the prospects for 2025, but it has been an uncertain start to the year, with global turmoil overshadowing what was predicted to be a year of recovery for UK construction and housebuilding, in particular.

“The Construction Products Association Spring Forecast noted that any uplift in overall construction outputs this year will now be very gradual – just +1.9% growth is predicted from a low base. Private housing output, still challenged by affordability constraints and weak demand, is forecast to increase by just +4.0%. The industry had hoped for better in 2025, given Government commitments to housebuilding, and RMI has also had a sluggish start.

“But the year is not a write off. According to Aviva’s How We Live report, almost seven million homeowners plan to renovate their home in 2025. Wages are rising faster than inflation, and further rate cuts are expected. However, politics at home and abroad weighed heavy on consumer sentiment.”

The Builders Merchant Building Index (BMBI)

The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses NiQ GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from 88% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk.

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.rdr.link/dbe022