Glenigan has released the January edition of its Construction Review.

This special edition covers all major (>£100m) and underlying (<£100m) projects, with all underlying figures seasonally adjusted, and looks back at year-on-year performance to gauge where the industry stands as the new year begins.

The report provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals a unique insight into sector performance over the past year.

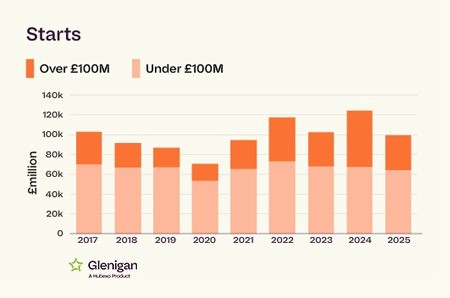

Unfortunately, despite performance picking up pace in Q4 2025, it proved to be a disappointing year overall, with activity significantly down against 2024 levels and the values of projects starting on site slashed by a fifth (-20%).

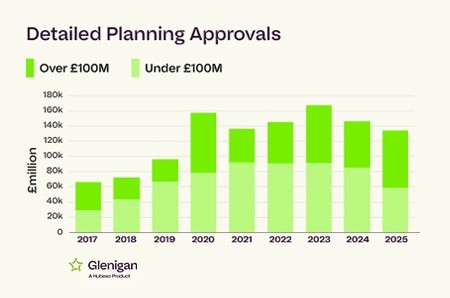

Less severe, yet equally unimpressive, are detailed planning approvals. These dipped by 8% and main contract awards fell by 11%.There’s little doubt for many across the sector that these lacklustre figures were the result of a perfect storm of domestic socioeconomic uncertainty and ongoing turmoil on the international stage.

It’s all leading to what has become a frustratingly persistent pattern of uncontrolled decline.

This is reflected in the stubbornly high interest rates squeezing developers, contractors and subcontractors through the majority of 2025, combined with weak investor confidence, ongoing cost pressures and a period of policy flip-flopping between the Spring Spending Review and the Autumn Budget Statement.

Whilst there were a few pockets of resilience which stood out against a largely gloomy landscape, including Industrial, Offices and Hotels & Leisure, their relative success did little, if nothing, to offset a challenging 12-months for everyone across UK construction.

Commenting on the results, Glenigan’s Economics Director, Allan Wilen, says: “Once again, it feels like the industry has been stuck in a vicious cycle where any established momentum, as we saw in the residential market in the spring, suddenly vanishes sometimes due to the tiniest twitch upon a thread. Issues that under normal circumstances would be unremarkable, can have an immediate impact on confidence and activity, showing how fragile and sensitive the UK and global economy remain.”

However, against this dim backdrop, Allan remains optimistic for the year ahead.

He continues: “Despite these poor results, we’re starting to see stability return, particularly a surge in Non-Residential work, noted in our most recent Index. Whilst it’s going to take a little time, the Chancellor’s Autumn Statement gave a far clearer funding commitment which will hopefully get shovels in the ground, plans approved and contracts awarded on a wide range of capital projects.

“This could further be the key to unlocking both private investors and in turn, consumer confidence; we’re already seeing the key starting to turn with a recent upsurge in Office and Industrial activity. It highlights that, whilst UK construction is certainly down at the start of 2026, it’s by no means out.”

Find out more about Glenigan by visiting: www.glenigan.com