New research by the Federation of Master Builders indicates that construction industry bosses are preparing for a potential downturn.

Construction industry bosses are reorganising their workforce in preparation for a potential downturn, with higher levels of sub-contracting and lower levels of direct employment, according to new research by the Federation of Master Builders (FMB).

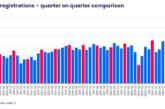

The analysis is part of the results from the FMB’s State of Trade Survey for Q2 2019, a quarterly assessment of the UK-wide SME construction sector.

The research shows that there has been a decrease in employment levels among small construction firms for the first time in more than five years, with over one fifth (21%) of employers reporting a reduced workforce.

Brian Berry, Chief Executive of the FMB, said: “Years of Brexit uncertainty have resulted in construction bosses starting to change how they employ their workforce. To ensure their firms are ready for any economic shock-waves later this year, employers are reducing their number of direct employees and relying more on sub-contractors who are easier to shed if work dries up. The construction industry has always used a significant proportion of subbies but the fact that direct employment is decreasing, points to Brexit nerves among construction bosses.”

Bricklayers are the trade in shortest supply in the market, with nearly two-thirds (60%) of construction SMEs struggling to hire these tradespeople. 54% struggle to hire carpenters and joiners.

Berry highlighted concerns that an increase in the use of sub-contractors may lead to a drop in the quality of builds. He noted: “Direct employees, who are well-known to their firm, are much more likely to follow the ethos of their company and build to the right standard. If construction bosses are trying to protect their businesses by employing more subbies, they might not always know how good these subbies are. Rebalancing the workforce may seem like a good idea at the time, but it could lead to reputation-damaging mistakes. If a downturn is on the horizon, reputation is everything and construction employers can scrutinise the quality of their workforce far more easily when they’re on the books.”

Looking ahead, expectations for the future weakened slightly. According to the research just over one third of construction SMEs (37%) are forecasting higher workloads over the coming three months, down from 41% in Q1 2019.