Biodiversity Units UK is proud to announce the release of its latest report, “The BNG Report: Pricing & Key Insights – July 2024,” which offers an in-depth analysis of current pricing trends and market insights in the Biodiversity Net Gain (BNG) sector across England.

This essential resource provides developers and suppliers with critical information to navigate the evolving BNG offsite unit market.

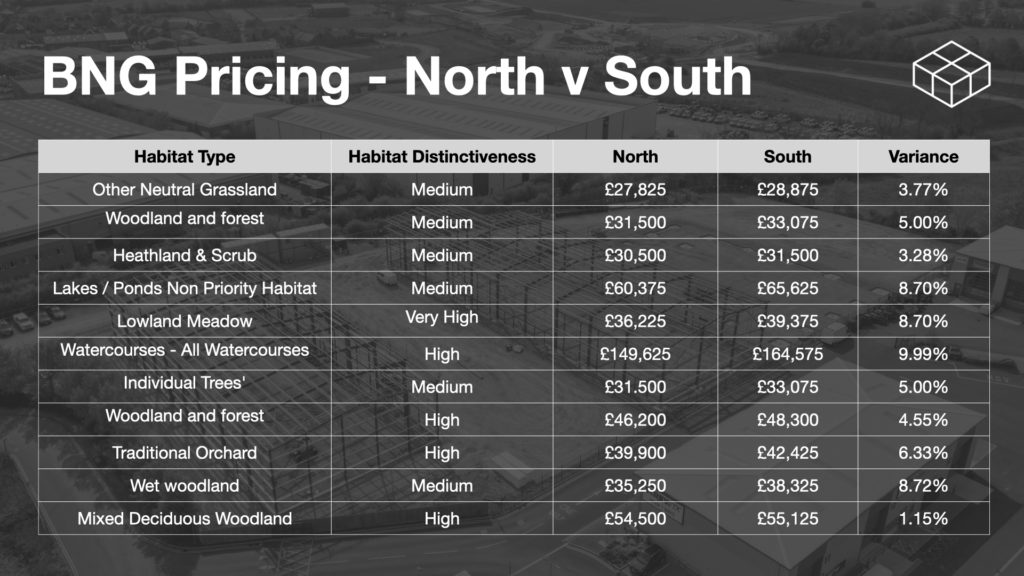

The report, created in partnership with Arbtech Ecologists, compiles data from 38 BNG suppliers across England, examining pricing details, transactions and consulting with industry experts to present an average pricing list segmented by common habitats across two regions: England South and England North. These insights highlight significant price variances and supply levels, providing a detailed landscape of the BNG market at the end of the first half of 2024.

Key Highlights from the Report:

Key Highlights from the Report:

- Regional Pricing Differences:

- The report clearly outlines the pricing differences between the North and South of England. For instance, the price for “Other Neutral Grassland” in the North is £27,825 compared to £28,875 in the South, reflecting a 3.77% variance. Similarly, “Lakes / Ponds Non Priority Habitat” is priced at £60,375 in the North and £65,625 in the South, marking an 8.70% difference.

- Education on BNG: There’s a notable lack of market education regarding BNG, with many developers embarking on their initial BNG deals, highlighting the need for enhanced training and resources.

- Registered Suppliers: The DEFRA ‘Biodiversity Gain Site Register’ lists only nine suppliers, indicating a limited number of certified providers.

- Development Challenges: A significant number of BNG sites are under development but do not have the prerequisite Section 106 agreements due to local authorities’ insufficient preparation for recent legislation, causing delays in compliance.

- Property Market Impact: The current downturn in the property market, compounded by high interest rates, has resulted in fewer transactions. However, potential market recovery could lead to rapid price fluctuations due to limited unit availability.

- Small Site BNG Demand: There is a growing requirement for ‘Small Site BNG’ and fractionalised units, yet the registry process remains complex, with a shortage of supporting providers.

- Rise in BNG Activities: Ecologists are reporting a surge in BNG-related surveys and contracts, with some experiencing revenue increases of over 250% in the past year, reflecting the sector’s growing significance.

Ian Hambleton, Founder, Director at Bio Units UK said “We’re very pleased to be able to launch this pricing report today, looking at costs of BNG Units at the end of July 2024. Created using data from 38 BNG suppliers across England, from industry contacts and connections and from transactions we’re seeing in the market. We hope these give Developers more knowledge on the costs of BNG and we’ll be updating these quarterly as the market evolves.”